Fiscal 2020 Further Consolidated Appropriations Act - H.R.1865

Executive Summary of HR 1865

The agreement consists of eight FY 2020 appropriations bills that combined provide a total of $539.9 billion in discretionary funding for FY 2020.

The total includes $520.4 billion subject to caps, $8.6 billion in OCO funding, $6.8 billion in emergency funding, $1.8 billion in program integrity funding, and $2.3 billion under a special cap adjustment for wildfire suppression funding, according to the Congressional Budget Office.

Appropriations Bills

Under the measure, funding is provided for the following eight spending bills:

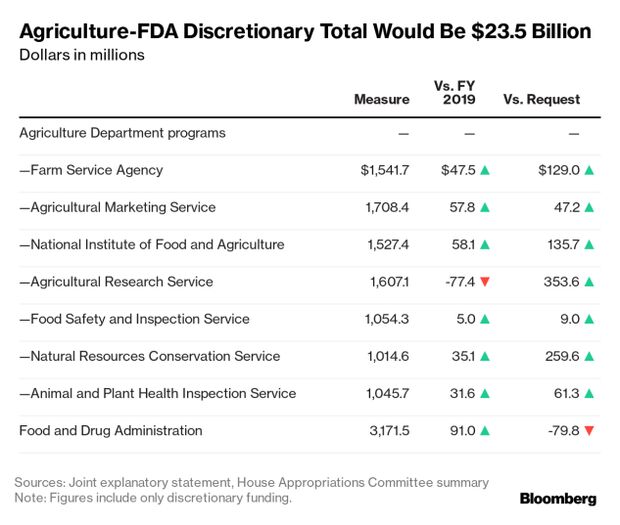

Agriculture — $23.5 billion in discretionary funding subject to budget caps — $183 million (1%) more than FY 2019, according to Democratic appropriators. Together with mandatory spending for programs such as food stamps, it provides a total of $154 billion for the Agriculture Department (USDA), the Food and Drug Administration (FDA) and other covered agencies — $1.3 billion (1%) more than comparable FY 2019 funding. It also allows up to $46.6 billion in loans for farmers and rural development programs.

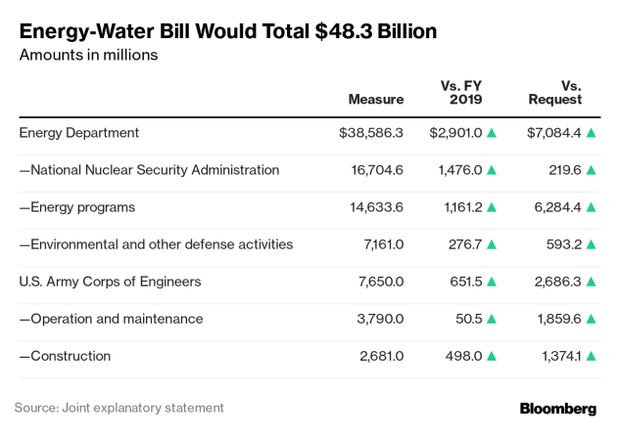

Energy-Water — $48.3 billion in appropriations subject to discretionary caps for FY 2020, $3.7 billion (8%) more than the FY 2019 level and $10.3 billion (27%) more than the administration's request. Of the total, $24.3 billion is for defense-related activities ($1.0 billion more than FY 2019) and $24.1 billion is for nondefense activities ($1.9 billion more) according to the House Appropriations Committee.

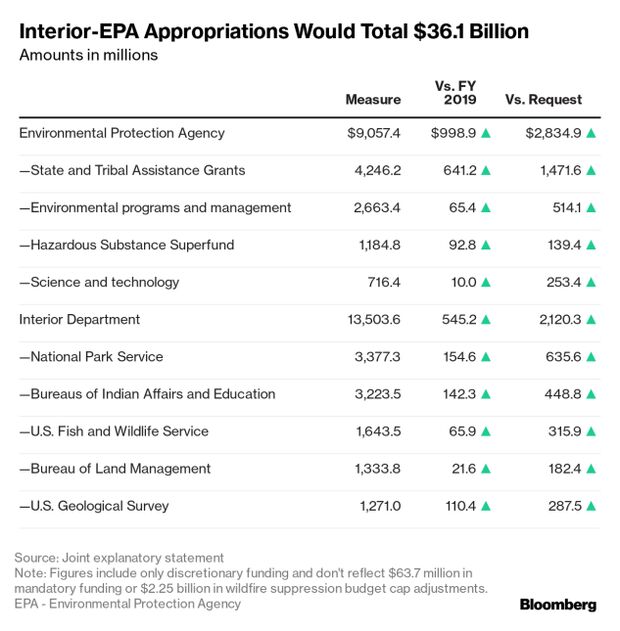

Interior-Environment — $36.0 billion in net discretionary spending subject to budget caps — $437 million more than FY 2019 funding and $5.8 billion more than the administration's request, according to the appropriations committee.

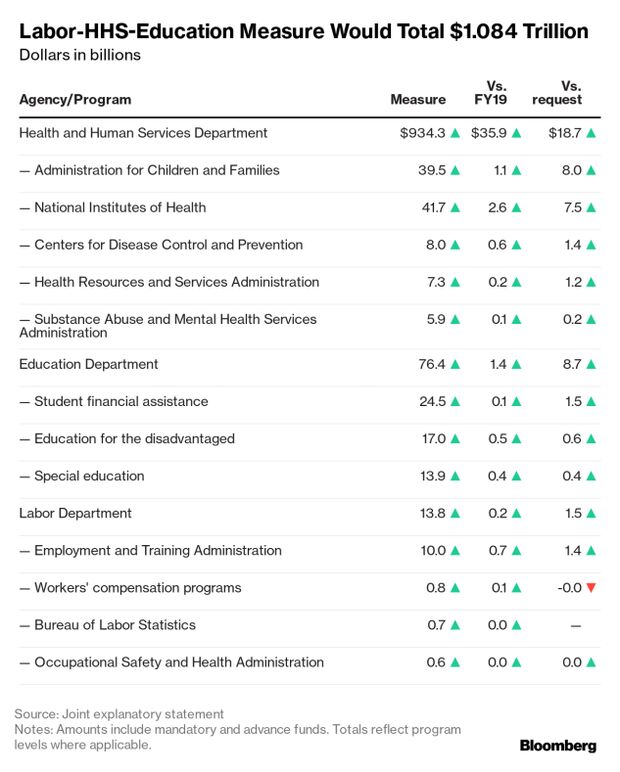

Labor-HHS-Education — $184.9 billion in discretionary spending subject to caps for FY 2020, including advance funding for FY 2020 enacted in prior years. According to appropriators, that total is $4.9 billion (3%) more than the comparable FY 2019 level and $43.0 billion (30%) more than requested by the president.

Legislative Branch — $5.0 billion for discretionary operations of the House of Representatives, Senate, and legislative branch entities. The total is $203 million (almost 4%) more than the FY 2019 level but $239 million (4.5%) less than was requested by the offices and agencies covered by the measure.

Military Construction-VA — $110.3 billion in discretionary funding for FY 2020, according to Senate appropriators, including $6.2 billion in emergency disaster funding and $645 million in Overseas Contingency Operations (OCO) funding. The total is $10.7 billion more than comparable FY 2019 funding.

State-Foreign Operations — $467 million more than comparable FY 2019 funding and $11.3 billion more than the president's request (which included no OCO funding), according to House appropriators.

Transportation-HUD — $74.3 billion in net spending subject to discretionary caps (including advance appropriations from prior years) and $61.3 billion from the highway and aviation trust funds — for a total of $135.6 billion for FY 2020. That total is $1.2 billion more than FY 2019 (excluding emergency FY 2019 appropriations) and $15.8 billion more than requested.

Legislative Provisions

Congressional leaders have also attached to this spending bill package numerous legislative provisions dealing with various issues, including the following:

Tax Extenders — Retroactively extends for 2019 through 2020 more than two dozen temporary tax provisions that expired at the end of 2018 and extends others that are about to expire at the end of 2019.

Repeal ACA Taxes — Permanently repeals three major health industry taxes that were imposed to help pay for Obamacare. The measure repeals the so-called "Cadillac Tax" on expensive employer-provided health insurance plans provided by wealthy companies and major labor unions. It also repeals a 2.3% tax on medical devices and a health insurance fee.

Health Care Reauthorizations — Extends and programs for outreach, enrollment, and education activities for low-income Medicare beneficiaries seeking insurance coverage; activities related to quality measurement and performance improvement in the Medicare and Medicaid programs; a program to reimburse hospitals for the costs of searching for donors and acquiring cells and bone marrow; as well as other health programs.

Age Limit for Tobacco Purchases — Increases the minimum age of sale of tobacco products from 18 to 21 years of age.

Coal Miner Pensions & Health — Prevents insolvency of the 1974 UMWA Pension Plan and protects health benefits for miners impacted by coal company bankruptcies that took place in 2018 and 2019.

Medicaid Funding for U.S. Territories — Extends numerous programs relating to health care including extending funding to U.S. territories for FY 2020 and FY 2021. It includes program integrity improvements for Puerto Rico's Medicaid program and will include a federal match rate of 76% for Puerto Rico and 83% for the other territories.

Ex-Im Bank Reauthorization — Extends the charter of the U.S. Export-Import Bank for seven years and provides for procedures to establish a temporary board in the absence of a sufficient number of Senate-confirmed directors to comprise a quorum.

Terrorism Risk Insurance — Reauthorizes the program for seven years through Dec. 31, 2027 and adjusts the timing of mandatory recoupment.

AGRICULTURE-FDA

The Agriculture Department (USDA), Food and Drug Administration (FDA), and related agencies would receive $23.5 billion in discretionary funding in fiscal 2020 under the agreement, according to a summary from the House Appropriations Committee. That amount would be $183 million more than the fiscal 2019 level.

The measure also includes mandatory funding for nutrition assistance and crop insurance programs, among other things, bringing the total to $153.5 billion, which would be $3.96 billion less than fiscal 2019.

The FDA would have a total funding level of $5.87 billion after accounting for receipts from user fees, $196.3 million more than in fiscal 2019 and $193.8 million less than requested.

Other Funding Highlights

Rural Development: The agreement would provide $3.24 billion for rural development programs, an increase of $228.9 million from fiscal 2019 and $302.6 million more than requested.

It also would require USDA to set aside funding for its Rural Economic Area Partnership Program, also called REAP Zones, equal to the amount spent in the most recent fiscal year in which any such funding was spent.

Domestic Food Programs: Domestic food programs would receive $98 billion, $5.18 billion less than in fiscal 2019 and $969.1 million less than requested. That would include mandatory funding for the Supplemental Nutrition Assistance Program (SNAP) and child nutrition programs.

The agreement would provide:

- $67.9 billion for SNAP, a decrease of $5.59 billion from fiscal 2019 and $1.18 billion less than requested.

- $23.6 billion for child nutrition, an increase of $474.3 million from fiscal 2019 and $328.1 million less than requested.

- $6 billion for WIC, a decrease of $75 million from fiscal 2019 and $250 million more than requested.

- $344.2 million for commodity assistance programs, an increase of $22.1 million from fiscal 2019 and $288.8 million more than requested.

Foreign Assistance: The measure would provide $2.17 billion for foreign aid and related programs. That would be an increase of $234.7 million from fiscal 2019 and $1.97 billion more than requested.

It would provide $1.73 billion for Food for Peace grants and $220 million for the McGovern-Dole International Food for Education and Child Nutrition Program. The White House had proposed zeroing out both line items.

Policy Riders

The agreement would require the FDA to issue a request for information on potential next steps to address illnesses associated with use of e-cigarettes and vaping products.

It would require USDA to finalize, within 180 days of enactment, a proposed rule that would specify procedures for producers to transition dairy farms from nonorganic to organic management once over a 12-month period.

The measure would block any use of funds to prohibit growing, selling, processing, or researching hemp, which was legalized in the 2018 farm law (Public Law 115-334).

It also would require the Animal and Plant Health Inspection Service to restore an updated searchable database to its public website with animal welfare and horse protection inspection reports and enforcement records. The service said in February 2017 it would remove thousands of records from the database, which included information on facilities like research labs, zoos, wholesale pet dealers, and breeders.

It doesn’t include language from the House-passed Agriculture-FDA funding bill that would:

- Block USDA proposals to relocate two research agencies outside of the Washington, D.C., region.

- Bar funding to finalize or implement a rule allowing for unlimited line speed at hog slaughterhouses.

ENERGY-WATER

The Energy Department, Army Corps of Engineers, and related agencies would receive a combined $48.3 billion in fiscal 2020 under the agreement.

That total would be a $3.66 billion increase from fiscal 2019, not including emergency appropriations, and $10.4 billion more than the White House requested, according to the joint explanatory statement.

Of the total, $24.3 billion would be under the defense spending cap, and the remaining $24.1 billion would be under the nondefense cap.

Major spending allocations in the agreement would include:

Energy Department

Within those amounts, the measure would provide:

- $12.5 billion for NNSA weapons activities.

- $7 billion for science.

- $6.26 billion for defense environmental cleanup and $319.2 million for nondefense environmental cleanup.

- $2.79 billion for energy efficiency and renewable energy.

- $2.16 billion for defense nuclear nonproliferation.

- $1.65 billion for naval nuclear reactors.

- $1.49 billion for nuclear energy research, including both defense and nondefense functions.

- $750 million for fossil energy research.

- $425 million for the Advanced Research Projects Agency-Energy (ARPA-E), which the president’s budget proposed eliminating.

The agreement doesn’t include $116 million in requested defense and nondefense nuclear waste disposal money.

The agreement would direct the Energy Department to sell $450 million worth of crude oil from the Strategic Petroleum Reserve (SPR) in fiscal 2020 to fund the reserve’s Life Extension II project. It also would authorize the sale of refined petroleum products from the SPR if there’s a regional supply shortage of significant scope and duration that would likely lead to a “severe” price increase.

Other Energy Department highlights include:

- Requiring the Southeastern Power Administration to pay its workers prevailing market wages beginning in fiscal 2020. Wages would be capped at the basic pay rate for level V of the Executive Schedule, which is $156,000 in 2019.

- Barring the use of nuclear nonproliferation funds to provide assistance to Russia.

Army Corps of Engineers

The measure would provide for six new construction projects and six new feasibility studies identified in a work plan the Corps has submitted to Congress.

The measure would continue to bar the Trump administration from reorganizing the Corps to transfer its civil works functions out of the Defense Department.

Unlike the House-passed bill, the measure doesn’t include provisions to prohibit the use of Corps funding to design or construct barriers or security infrastructure on the southern border.

Interior Department

Interior Department agencies would receive $1.68 billion under the Energy-Water part of the agreement. Almost all of that amount, $1.66 billion, would go to the Bureau of Reclamation, which is responsible for maintaining federal water and hydropower projects in the West.

The majority of Interior Department funding is provided through the Interior-Environment portion of the agreement.

INTERIOR-ENVIRONMENT

The agreement would provide the EPA, Interior Department, and other land management agencies with a combined $36.1 billion in appropriations, according to the joint explanatory statement.

That total would be $265.4 million more than the fiscal 2019 level and $5.46 billion more than the president’s budget request. Comparisons don’t reflect $2.09 billion in disaster appropriations provided to the EPA, Interior Department, and related agencies in fiscal 2019.

Major discretionary allocations would include:

Wildfire Funding

The measure would provide $3.3 billion for wildfire management and suppression activities conducted by the Interior Department and Forest Service. That would be $643.2 million less than in fiscal 2019 and $32.4 million more than requested.

The agreement also includes $2.25 billion in requested budget cap adjustments that would provide additional spending authority to meet suppression costs that exceed the appropriation, bringing total potential wildfire funding to $5.55 billion.

EPA Highlights

Other EPA funding highlights would include:

- $1.64 billion for the Clean Water State Revolving Fund and $1.13 billion for the Drinking Water State Revolving Fund.

- $510.3 million for geographic programs, such as the Great Lakes and Chesapeake Bay initiatives, an increase of $53.3 million from fiscal 2019 and $203 million more than the request.

Interior Department

The measure would provide $495.1 million for projects supported by the Land and Water Conservation Fund. That would be $56.8 million more than in fiscal 2019 and $462.2 million more than requested.

The measure would extend payments in lieu of taxes to local governments through fiscal 2020. The payments, often called PILT, are meant to offset local revenue losses because the federal government doesn’t pay property taxes.

The measure would extend through Oct. 1, 2021, the Interior Department’s authority to collect and spend recreation fees at national parks and other federal lands.

Policy Riders

The agreement would block all federal oil and gas leasing within 10 miles of Chaco Culture National Historical Park in New Mexico until the Bureau of Indian Affairs completes a cultural resources investigation.

The agreement omits riders from the House’s bill that would restrict the Trump administration’s offshore leasing plan and lease sales in the Arctic National Wildlife Refuge.

The measure includes several EPA policy riders enacted under previous spending laws that were omitted from the House-passed fiscal 2020 Interior-Environment bill. They would:

- Prohibit regulating greenhouse gas emissions from livestock and requiring reporting on emissions from manure management systems.

- Ban regulating the lead content of ammunition and fishing tackle.

- Require all federal agencies to treat energy from burning forest biomass, which is generally in the form of wood pellets, as carbon neutral and a renewable energy source.

- Bar enforcement of a rule on emissions from small remote incinerators in Alaska.

Other Agency Funding

Forest Service: The U.S. Forest Service, part of the Agriculture Department, would receive $5.48 billion, a reduction of $603.7 million from fiscal 2019 and $347.4 million more than requested. Of that total, $3.13 billion would be for non-wildfire research, management, and other programs, such as administering the National Forest System. That would be $50.6 million more than in fiscal 2019 and $347.4 million more than requested

The measure also includes an additional $1.95 billion spending cap adjustment to account for wildfire costs that exceed expectations.

Indian Health Service: The Indian Health Service, part of the Health and Human Services Department, would receive $6.05 billion, $242.9 million more than in fiscal 2019 and $137.5 million more than requested.

LABOR-HHS-EDUCATION

The agreement would provide $184.9 billion in discretionary appropriations for the Health and Human Services, Education and Labor departments, and several related agencies, which would be $4.9 billion more than fiscal 2019, and $43 billion more than requested.

When mandatory funding is included, the total for the Labor-HHS-Education portion of the spending agreement would be $1.084 trillion, $38.4 billion more than in fiscal 2019, and $44.7 billion more than requested, according to the joint explanatory statement on the measure.

Health and Human Services Department

CMS Funding: Including mandatory and advanced funding, the measure would provide $828.3 billion for the Centers for Medicare and Medicaid Services, $31.4 billion more than fiscal 2019 and $84.3 million more than requested.

Opioid Funding: Several agencies within HHS would receive funding for opioid treatment, prevention, and research, including:

- $1.5 billion for state opioid response grants administered by the Substance Abuse and Mental Health Services Administration.

- $475.6 million for opioid overdose prevention and surveillance at the Centers for Disease Control and Prevention.

- At least $250 million for opioid misuse and addition research at the National Institutes of Health, according to the joint explanatory statement.

- $89 million for medication-assisted treatment programs.

Abortion Prohibitions: The measure would continue the Hyde Amendment, which bars the use of federal funds to pay for abortion services, with exceptions for rape or incest or when the mother’s life is endangered.

It also would continue the Weldon Amendment, which prohibits federal agencies from discriminating against providers that don’t perform abortions.

The measure omits House-passed language to block a Trump administration rule banning Title X family planning funds from going to clinics such as Planned Parenthood that perform or discuss abortions. The measure would provide $286 million for the Title X program.

Planned Parenthood receives funding from Bloomberg Philanthropies, the charitable organization founded by Michael Bloomberg. Michael Bloomberg is the majority owner of Bloomberg Government’s parent company.

Gun Research: The measure includes $25 million for gun violence research at the CDC and NIH.

The agreement would continue to prohibit the CDC from advocating for gun-control measures, a provision known as the Dickey Amendment.

Everytown for Gun Safety advocates for universal background checks and other gun control measures. Michael Bloomberg, who serves as a member of Everytown for Gun Safety’s advisory board, is the majority owner of Bloomberg Government’s parent company.

Refugee and Entrant Assistance: The measure would provide $1.9 billion for refugee and entrant assistance, $3 million more than in fiscal 2019 and $104.1 million more than requested. The measure would limit the ability of the department to make changes to the Office of Refugee Resettlement’s operational directives, unless written justification is provided to Congress and the HHS inspector general.

Education Department

The agreement would provide $10.6 billion for Head Start, $550 million more than fiscal 2019 and the requested amount.

The measure would increase the maximum Pell Grant Award by $150, for a total of $6,345 for the 2020-2021 academic year.

Charter Schools: The measure would provide $400 million for charter school grants, $40 million less than fiscal 2019 and $100 million less than requested. Appropriators said they were concerned by a recent report that found as much as $1 billion had been spent on schools that failed or never opened.

Loan Forgiveness: The measure would continue to provide $350 million to cancel loans for borrowers in the public service loan forgiveness program who weren’t eligible because of their repayment plan. It also would direct the Education Department to notify borrowers about the option to receive loan forgiveness under the bill.

Loan Servicing: The measure would require loan servicer contracts to be provided to those that comply with federal and state law, following an inspector general report on noncompliance among servicers. It also would require the department’s student loan servicing systems to include accountability measures that account for performance and compliance with federal guidelines.

Labor Department

According to the House appropriations committee summary, the measure would provide:

- $311 million for Veterans Employment and Training Service (VETS), $11 million more than fiscal 2019 and $5 million more than the president’s budget request.

- $106 million for the Office of Federal Contract Compliance Programs.

- $96 million for the International Labor Affairs Bureau.

Other Agencies

The agreement would also provide:

- $12.9 billion to the Social Security Administration for administrative expenses.

- $1.1 billion for the Corporation for National and Community Service.

- $485 million for the Corporation for Public Broadcasting.

LEGISLATIVE BRANCH

The measure would provide $5.05 billion in discretionary funding for the House, Senate, and legislative branch agencies, $203 million more than in fiscal 2019.

Block COLA: Members of Congress would be barred from receiving an automatic cost-of-living increases in fiscal 2020. Since the last increase, in 2009, rank-and-file members make $174,000 per year, while the rates are $223,500 for the speaker and $193,400 for the Senate majority and minority leaders.

Staff Pay: The measure would increase the maximum staff member salary to $173,900, at the discretion of the employing entity. The current limits are $169,459 in senators’ offices and $168,411 in House member offices, with additional amounts allowed for some committee staff. “This language responds to wide complaints that salary levels prevent Congress from being able to attract staff with required levels of technical expertise to address the increasingly complex policy issues facing the Members,” the House Appropriations Committee wrote in a summary document.

House of Representatives: The measure would provide $1.37 billion for the House, $133 million more than in fiscal 2019. Major allocations include $615 million, a $41.4 million increase, for the Members’ Representational Allowance used to fund individual offices, and $159.6 million, an $8.6 million increase, for committee offices. The measure also includes more than $11 million for intern compensation.

Senate: $969.4 million for the Senate, $34.6 million more than in fiscal 2019. The agreement boosts funding for the Senators’ Official Personnel and Office Expense Account by $20 million, to $449 million.

Architect of the Capitol: The agreement includes $695.9 million for the Architect of the Capitol, $37.8 million less than last year. The joint explanatory statement seeks an update within 60 days of enactment on how the office has addressed 16 inquiry results in a report about sexual harassment complaints over a 10-year period. It also would direct the AOC to work with American Indian professionals to address how American Indians are portrayed in the Capitol complex and to study how the flags of recognized tribes can be displayed in the Capitol campus.

Library of Congress: The measure would provide $725.4 million for the Library of Congress, $29.2 million more than last year. The measure would provide $42.1 million, $1.5 million less, for the Copyright Office, and $120.5 million, $5.2 million less for the Congressional Research Service.

Capitol Police: The measure would provide $464.3 million for the Capitol Police, an $8 million increase, which would support an additional 57 officers and one staff member for the inspector general’s office, according to the joint statement. The agreement would increase to $60,000, from $40,000, the maximum the Capitol Police can provide for an individual under an educational assistance program.

GAO: The Government Accountability Office would receive $630 million, $40.3 million more than in fiscal 2019, and could also spend $24.8 million from amounts it collects. The joint explanatory statement says the funding level would help the GAO “increase support for Congress’ work on evolving science and technology issues.”

No OTA: The measure wouldn’t provide funding to revive the Office of Technology Assessment, as the House version had proposed.

Other Accounts: The Government Publishing Office would receive $117 million, the same as in fiscal 2019. The Congressional Budget Office would receive $54.9 million, a $4.2 million increase. The Open World Leadership Center would receive $5.9 million, $300,000 more than in fiscal 2019. The Joint Committee on Inaugural Ceremonies would receive $1.5 million.

Inspector General Offices: The measure would authorize inspector general offices at the Library of Congress, Architect of the Capitol, and Government Publishing Office to submit independent budget requests; seek advice from counsel reporting directly to them or another inspector general; and make arrests, seek warrants, and carry firearms.

MILCON-VA

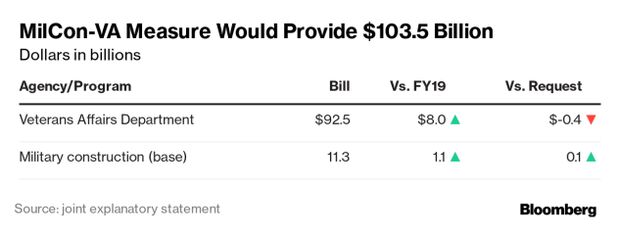

The Military Construction-Veterans Affairs section of the spending package would provide $103.5 billion in discretionary funding subject to spending caps, $6.4 billion more than the fiscal 2019 enacted level, according to a Senate Appropriations Committee summary.

Additional spending cap-exempt amounts would include:

- $6.23 billion for emergency disaster aid.

- $644.5 million for Overseas Contingency Operations activities.

Net discretionary totals subject to spending caps would include the following amounts:

Veterans Affairs Department

Veterans Health Administration: The Veterans Health Administration (VHA) would receive $93.1 billion, including $87.6 billion in advance funds for fiscal 2021.

Advance funding for VHA programs would include the following amounts:

- $56.2 billion for medical services.

- $17.1 billion for medical community care.

- $7.91 billion for medical support and compliance.

- $6.43 billion for medical facilities.

Medical Funding Highlights: Medical programs for veterans would include the following amounts:

- $9.43 billion for mental health, including $221.8 million for suicide prevention outreach.

- $1.85 billion for homeless veterans assistance programs.

- $800 million for medical and prosthetic research.

- $710 million to support caregivers of veterans.

- At least $585 million to treat female veterans.

- $402 million for opioid abuse treatment and prevention.

- $300 million for rural health.

Community Care: Community care would get a boost as the department implements the VA MISSION Act (Public Law 115-182), which allows veterans to get government-subsidized care from private providers under a single discretionary program.

The measure would provide $8.91 billion in fiscal 2020 and $11.3 billion in fiscal 2021 to implement the law, according to the joint explanatory statement.

It wouldn’t adjust the spending caps to make more room for community care funding, as some Democrats have requested.

Health-Care Policies: The measure includes policy provisions that would:

- Let eligible veterans receive infertility treatment and reimbursements for adoption expenses.

- Require the VA to provide immediate assistance from trained professionals when veterans call the department’s toll-free suicide hotline.

- Bar the use of funds for certain kinds of medical research involving canines, felines, or nonhuman primates.

Veterans Benefits: The measure would provide $131 billion in advance mandatory funds for fiscal 2021 for benefits such as disability compensation, educational aid, and job training.

It would also provide $3.13 billion in fiscal 2020 discretionary funds for general operating expenses at the Veterans Benefits Administration. That would include $125 million more than requested to help the VA implement legislation (Public Law 116-23) allowing “Blue Water Navy” veterans who served off the coast of southeast Asia to qualify for expedited benefits for diseases linked to Agent Orange.

The measure also would require the VA to update Congress within 30 days of enactment on its efforts to issue new rules designating diseases connected to herbicide agents that would qualify veterans for expedited benefits.

Other VA Programs: The measure also would provide:

- $4.37 billion, $268.6 million more than in fiscal 2019, for information technology systems.

- $1.5 billion, $393 million more than in fiscal 2019, for the department’s new electronic health record system.

- $1.24 billion for major construction projects and $398.8 million for minor projects.

Military Construction

Base funding for military construction would include:

- $7.68 billion for construction within active components of the armed forces, and $550.9 million for reserve components.

- $1.32 billion for family housing.

- $398.5 million for the Defense Department’s base closure account.

- $172 million for NATO’s Security Investment Program.

Border Wall: Appropriators rejected the president’s request for $3.6 billion in cap-exempt emergency money to replace any military construction funds that were reprogrammed for southern border barriers, and another $3.6 billion in emergency funds for future border wall construction.

STATE & FOREIGN OPS

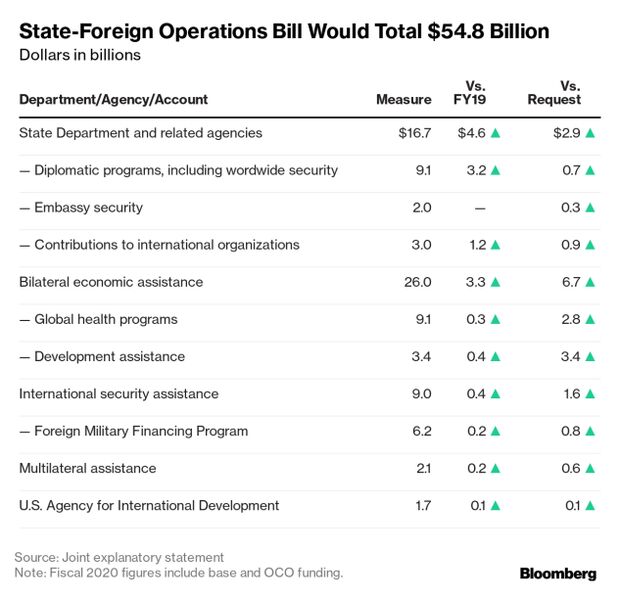

The State Department and foreign aid programs would receive $54.8 billion in discretionary funding in fiscal 2020 under the agreement. That amount would be $467 million more than the fiscal 2019 enacted level and $11.3 billion more than the president’s budget request, according to the joint explanatory statement.

It also would include $8 billion, the same as in fiscal 2019, in Overseas Contingency Operations (OCO) funding that doesn’t count against the discretionary caps.

State and Foreign Operations Highlights

The measure would provide:

- $5.93 billion for HIV/AIDS programs at the State Department and also would designate $1.56 billion for the Global Fund to Fight AIDS, Tuberculosis, and Malaria.

- $3.05 billion for the Economic Support Fund, $499.5 million more than in fiscal 2019.

- $1.39 billion for international narcotics control and law enforcement, $106.5 million less than in fiscal 2019 and $445.7 million more than requested.

- $905 million for the Millennium Challenge Corporation, $105 million more than requested.

- $895.8 million for nonproliferation, anti-terrorism, demining, and related programs, $188.6 million more than requested.

Country-Specific Provisions

The agreement would include:

- $3.3 billion in base funding for Israel, of which $805.3 million would be for Israeli procurement of defense articles and services.

- At least $2.54 billion to implement the Indo-Pacific strategy.

- At least $1.53 billion for Jordan.

- $1.43 billion in base funding for Egypt in Foreign Military Financing Program funds.

China: The measure would provide at least $300 million for a new Countering Chinese Influence Fund. It would prohibit funding in the measure from being used to support China’s Belt and Road Initiative or other “dual-use” Chinese projects, as well as Chinese technology. Diplomatic program funding couldn’t be used to process licenses to export satellites to China unless Congress is notified at least 15 days in advance.

Central American Countries: The measure would provide at least $519.9 million for Central American countries, including through the Central America Regional Security Initiative. It also would direct that at least $527.6 million provided for the region in fiscal 2019 be made available for its original purposes.

Iran: Funds provided under diplomatic programs and international security assistance could be used to implement sanctions against Iran for nuclear weapons development, terrorism, and human rights abuses.

Russia: The measure would provide at least $290 million for the Countering Russian Influence Fund. It also would bar funding in the measure from being used to support the Russian government, or a foreign government that recognizes Russia’s annexation of Ukrainian territory or its occupation of Georgian territory

Saudi Arabia: The measure would bar the use of funds to provide military education and training assistance to Saudi Arabia and prohibit Export-Import Bank support for nuclear technology exports to Saudi Arabia unless it has a nuclear cooperation agreement with the U.S.

Syria: Funds would be provided for nonlethal aid to Syria for emergency response and chemical weapons use investigations. Funds couldn’t be used to support the Iranian or Russian governments, foreign terrorist organizations, or areas controlled by the Assad regime.

Turkey: Funds for the sale of defense articles and services would be restricted unless the State Department reports to Congress that members of the Turkish president’s security detail have returned to the U.S. for indictment. The restriction wouldn’t apply to use of funds for border security purposes for NATO.

Other Policy Provisions

Abortion: The measure wouldn’t modify the Mexico City Policy, or the “global gag rule,” which prohibits assistance to foreign nongovernmental organizations that perform or promote abortions, even if those activities are carried out with non-U.S. funds.

The measure also would:

- Bar the use of funds to pay for any abortion or support any organization that uses coercive abortion or involuntary sterilization.

- Provide $32.5 million for the U.N. Population Fund, which couldn’t combine that amount with any other funding and would be barred from subsidizing abortions. It would bar program funds from being used in China.

Deposed Leaders: No funds could be used to support leaders or governments deposed by a coup or decree in which the military played a decisive role. Funds could be used to promote democratic elections.

Refugee Aid: The State Department would have to report to Congress on the U.N. Relief and Works Agency’s operations before funds are provided to the organization.

TRANSPORTATION-HUD

The Transportation Department, Housing and Urban Development Department (HUD), and related agencies would receive $135.6 billion for fiscal 2020. The measure would provide $4.52 billion more than in fiscal 2019 and $15.8 billion more than the administration requested. (Comparisons don’t reflect the $5.77 billion in emergency appropriations that transportation and housing programs received in fiscal 2019).

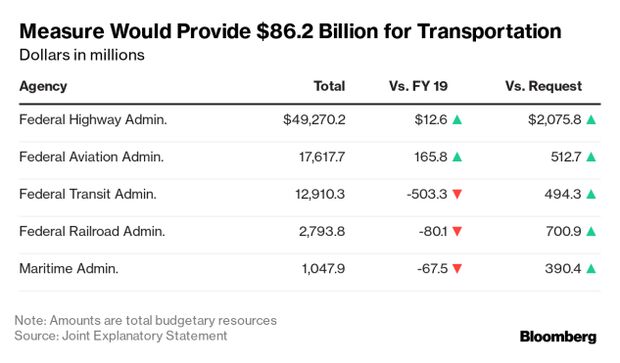

Transportation Department

The agreement would provide $86.2 billion in budgetary resources for the Transportation Department, including a net discretionary appropriation of $24.8 billion. Total resources would be $324.9 million less than in fiscal 2019 and $3.25 billion more than requested.

The major divisions of the department would be funded as follows, with total budgetary resources shown in comparison with what was provided in fiscal 2019 and what the administration requested:

The measure would provide $1 billion for Better Utilizing Investments to Leverage Development discretionary surface transportation grants, referred to in the bill as National Infrastructure Investments, an amount that would be $100 million more than in fiscal 2019.

The measure would provide money from the general fund for several discretionary infrastructure grants, including $2.17 billion for highways, $510 million for transit, and $400 million for airports.

It would provide $5 million to establish a Highly Automated Systems Safety Center of Excellence. The office would create institutional expertise that can guide future regulatory and rulemaking action on emerging technologies.

The measure includes several provisions related to the Federal Transit Administration’s Capital Investment Grant (CIG) program, which could affect the Gateway bridge and tunnel projects between New York and New Jersey. It would:

- Bar use of the bill’s funds to hinder advancement or approval for any project seeking a federal contribution greater than 40% of project costs.

- Eliminate a 51% cap on the federal share of the grants, according to a summary from House Appropriations Committee Democrats.

- Prevent the FTA from implementing the policies it detailed in a 2018 letter about CIG criteria. In the letter, the agency said it would classify loans from the Transportation Department as a federal contribution when calculating match requirements, which would count against the project in the agency’s evaluation of its local financial commitment.

Housing and Urban Development

HUD would receive a net appropriation of $49.1 billion under the measure, $4.88 billion more than in fiscal 2019 and $12.4 billion more than requested.

Major programs would be funded as follows:

- $23.9 billion for tenant-based rental assistance.

- $12.6 billion for project-based rental assistance.

- $4.55 billion for the Public Housing Operating Fund.

- $3.4 billion for Community Development Block Grants.

- $2.87 billion for the Public Housing Capital Fund.

- $2.78 billion for homeless assistance grants.

- $1.35 billion for HOME Investment Partnerships.

The measure includes $25 million within the Community Planning and Development account for a pilot to provide housing to individuals recovering from a substance use disorder, which was authorized under Public Law 115-271.

The measure would use receipts generated by the Federal Housing Administration and the Government National Mortgage Association to offset appropriations for HUD and keep the measure within its 302(b) allocation. In total, the FHA would generate a net $6.12 billion. Ginnie Mae would generate a net $1.15 billion.

The FHA could guarantee as much as $400 billion in loans under the Mutual Mortgage Insurance Program account and as much as $30 billion under the General and Special Risk Program account.