Raise the Wage Act - H.R. 582

The federal minimum wage would be increased to $15 an hour from $7.25 by 2025, and then adjusted annually based on median wages, under H.R. 582.

The bill also would gradually phase out separate lower wages for tipped workers, youth, and individuals with disabilities.

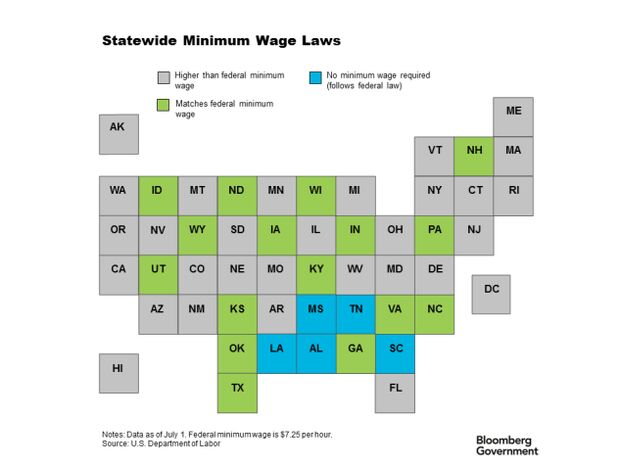

Twenty-nine states and Washington, D.C., have wage floors that are higher than the federal minimum as of July 1, according to the Labor Department.

Some cities and counties have even higher minimum wages, and several states have enacted laws requiring a $15 minimum wage to be in place by 2025 or earlier.

“We are now experiencing the longest period of time without an increase in the federal minimum wage since it was created in 1938,” said Rep. Bobby Scott (D-Va.), the bill’s sponsor and House Education and Labor Committee chairman, in a news release.

The last increase to the federal minimum wage was enacted in 2007 under Public Law 110-28, which set the wage at $7.25 an hour in 2009.

Minimum Wage Increases

The measure would increase the hourly minimum wage to at least $8.55 about three months after enactment.

Each year after that the minimum wage would increase to the following specified amounts:

- $9.85 one year after the initial increase.

- $11.15 two years after.

- $12.45 three years after.

- $13.75 four years after.

- $15 five years after.

After the minimum wage reaches $15 an hour, the Labor Department would have to annually adjust it, 90 days before its effective date, to reflect any percentage increases in the median hourly wage for all employees. The Bureau of Labor Statistics would compile data on hourly wages to determine the median.

The bill would stipulate that the minimum wage couldn’t decrease.

Tipped Workers

Under the Fair Labor Standards Act (FLSA), workers who make more than $30 a month in tips are paid a cash wage of $2.13 per hour by their employers. If the employee doesn’t earn enough tips to reach the $7.25 per hour federal minimum wage, the employer must cover the difference, called a “tip credit.”

The bill would increase the base hourly wage for tipped workers to at least $3.60 for the first year after the bill takes effect. In each subsequent year, it would be increased until it equals the minimum wage in 2027, according to a summary of the introduced version of the measure from the House Education and Labor Committee. At that point, the tipped wage would be effectively eliminated.

The base wage for tipped workers hasn’t been increased since 1991. In the past, it was equal to between 50 and 60% of the federal minimum wage.

Youth Workers

The hourly wage for employees younger than 20 would be increased to at least $5.50, from $4.25, for the first year after the bill takes effect. It would be increased in each subsequent year until it equals the minimum wage in 2027, after which it also would be effectively eliminated.

Workers with Disabilities

The measure would end the certificate process that employers use to provide subminimum wages to workers with disabilities.

Their hourly wage would have to be at least $4.25 beginning one year after the first increase in the minimum wage takes effect. It would then increase annually until it equals the minimum wage six years later.

The Labor Department would have to provide technical assistance to employers who have certificates to help them transition to the new framework and ensure continuing employment opportunities for individuals with disabilities.

Other Provisions

The measure’s provisions would apply in the Commonwealth of the Northern Mariana Islands 18 months after the first increase in the minimum wage takes effect.

The Labor Department would have to post changes to the minimum wage in the Federal Register and on its website 60 days before it would take effect.

Budget Effects

Implementing the bill would cost $76 million from fiscal 2019 through 2029, subject to appropriation, according to an April 22 cost estimate from the Congressional Budget Office.

Changes to minimum hourly wages would affect an estimated 100 U.S. Postal Service workers, which would increase off-budget mandatory spending by about $700,000 from fiscal 2020 through 2029, CBO wrote.

CBO said uncertainty in the cost estimate is linked to the projections of increases in the median hourly wage and wage growth for federal employees.

The bill would impose intergovernmental and private-sector mandates by requiring employers to pay a higher minimum wage to workers who are covered by the FLSA. CBO said the cost of the mandates would exceed the thresholds established in the Unfunded Mandates Reform Act, which are $82 million for intergovernmental mandates and $164 million for private-sector mandates in 2019 and adjusted annually for inflation.

The cost to state, local, and tribal governments would be about $3 billion in fiscal 2025, when the minimum wage reaches $15. The cost to private employers would be about $48 billion.

The annual costs to comply with the measure don’t account for possible employer responses to higher wage requirements, which could include reducing hiring. Costs, however, would still remain higher than the thresholds, according to CBO.

Lawmakers can raise a point of order against measures that would impose unfunded mandates on state, local, and tribal governments if the costs exceed the intergovernmental mandate threshold.

CBO also estimated in a July 8 report that increasing the minimum wage to $15 an hour could result in 1.3 million fewer workers with jobs in 2025, according to its median estimate, while boosting wages for 17 million workers.

Administration Position

Though the White House hasn’t release a statement of administration policy on the measure, President Donald Trump said in June he’s deliberating support for increasing the minimum wage and that wages have improved during his presidency.

Trump’s economic adviser, Larry Kudlow, opposes a national minimum wage, Bloomberg Law reported in February. Labor Secretary Alexander Acosta has also said that he doesn’t support raising the minimum wage.

Group Positions

More than 350 groups signed onto a January 2019 letter SUPPORTING the bill, including the AFL-CIO, AFSCME, NAACP, National Disability Rights Network, National Education Association, and the National Employment Law Project.

The Center for Medicare Advocacy also SUPPORTS the measure.

“The bulk of recent economic research on the minimum wage, as well as the best scholarship, establishes that prior increases have had little to no negative consequences and instead have meaningfully raised the pay of the low-wage workforce,” said Ben Zipperer, an economist at the Economic Policy Institute, during a February House Education and Labor Committee hearing.

Groups that OPPOSE the measure include the National Restaurant Association and National Federation of Independent Businesses.

“Setting the wage floor substantially higher than the productivity of many workers will likely result in significant employment reductions,” said the American Enterprise Institute’s economic policy studies director, Michael R. Strain, at the committee hearing.

U.S. Chamber of Commerce President Thomas Donohue said in January that a $15 minimum wage might halt some of the progress that immigration reform and more worker training initiatives could bring to the nation’s economy.

Previous Action

Scott introduced the bill, called the “Raise the Wage Act,” on Jan. 16. It had 205 cosponsors, all Democrats, as of July 8.

The House Education and Labor Committee approved an amended version of the bill by a 28-20 party-line vote on March 6. The panel adopted a substitute amendment that added provisions related to the Commonwealth of the Northern Mariana Islands.

Sen. Bernie Sanders (I-Vt.) introduced a companion bill (S. 150) on Jan. 16. It was cosponsored by 31 Democrats as of July 8. The Senate Health, Education, Labor, and Pensions Committee (HELP) hasn’t considered the measure.

Prospects

House Majority Leader Steny Hoyer (D-Md.) said the House will consider legislation to increase the minimum wage during the week of July 15, according to a July 5 dear colleague letter.

The measure is unlikely to be considered in the Republican-controlled Senate. HELP Committee Chairman Lamar Alexander (R-Tenn.) “has never supported the federal government fixing wages.”

Raise the Wage Act

Sens. Patty Murray (D-WA), the top Democrat on the Senate labor committee, and 30 of her Senate colleagues, including Sen. Maria Cantwell (D-WA), introduced legislation to raise the federal minimum wage to $15 an hour. Reps. Bobby Scott (D-VA) and Keith Ellison (D-MN) introduced a companion bill with 152 cosponsors in the House.

The Raise the Wage Act would raise the minimum wage to $15 per hour by 2024 and would be indexed to median wage growth thereafter. This raise would increase the minimum wage higher than its 1968 peak. The federal minimum wage has not been raised since 2009.

The bill will also gradually eliminate the loophole that allows tipped workers and workers with disabilities to be paid substantially less than the federal minimum wage, bringing it to parity with the regular minimum wage. Moreover, it would also phase out the youth minimum wage, which allows employers to pay workers under 20 years old a lower wage for the first 90 calendar days of work.

Should Congress raise the minimum wage to $15 per hour by 2024 and index it to median wage growth thereafter?